iLending is the national leader in car refinancing, saving consumers an average of $132 per month* in car payments. Through a best-in-class process and strategic partnerships, we offer terms that consumers cannot find on their own.

We exist to empower better financial lives by reducing burdens and improving peace of mind.

Applying takes minutes, will not impact your credit score and may save you hundreds or even thousands of dollars. Imagine what you could do with an extra $132 per month*. Vacation with the family? Pay off some nagging bills? Build up that savings account? It’s up to you!

Unlock your savings potential! Plug in your info to find out how much extra cash you could be stashing away each month!

We may be able to help. Call 1-866-683-5505 or 720-443-4726 (Espanol)

It looks like you might be in good shape! We may still be able to help!

Call 1-866-683-5505 or 720-443-4726 (Espanol)

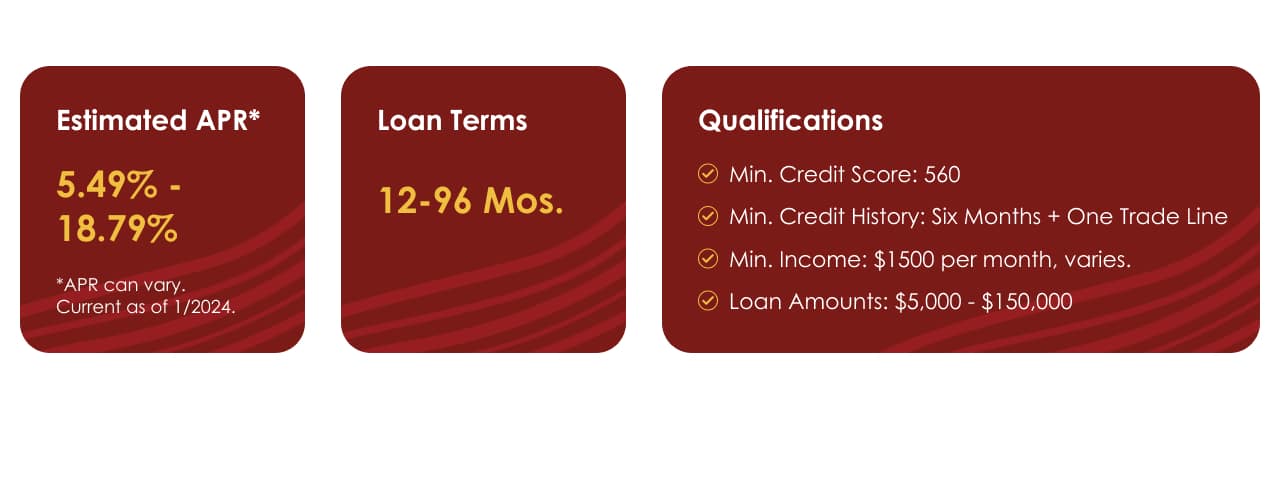

The calculated monthly payment above is based on the APR, loan term, and loan amount you entered. Your payment may change if any of these terms vary. APR is the Annual Percentage Rate. Advertised rates depend on the individual’s credit and key financing characteristics, including but not limited to the amount financed, term, a loan-to-value (LTV) ratio of less than or equal to 80%, and other vehicle characteristics. A representative example of payment terms are as follows: an Amount Financed of $25,000 with an APR of 7.50% and a term of 72 months would have a monthly payment of $432.25. APRs shown are current as of June 1, 2020 and are inclusive of an automatic monthly payment via Automated Clearing House (ACH). Advertised rates are subject to change without notice.

Unlock your savings potential! Plug in your info to find out how much extra cash you could be stashing away each month!

We may be able to help. Call 1-866-683-5505 or 720-443-4726 (Espanol)

It looks like you have a great rate already! If you’d like to talk, please call 1-866-683-5505 or 720-443-4726 (Espanol)

The interest rate displayed is based on the FICO score you entered. Your interest rate may change based on any variance in FICO reported by Credit Bureau. Advertised rates depend on the individual’s credit and key financing characteristics, including but not limited to the amount financed, term, a loan-to-value (LTV) ratio of less than or equal to 80%, and other vehicle characteristics. Advertised rates are subject to change without notice.

Famatta purchased her vehicle at an astounding 35.69% interest rate. iLending lowered her APR to just 13.6% and reduced her monthly payment by $371, allowing her and her husband to save money for a new home.